Managing your oral health while maintaining financial security is crucial, and dental insurance plays an essential role in achieving that balance.

By understanding how dental insurance works and the options available, you can make informed decisions to safeguard both your health and your finances.

Understanding Dental Insurance

Dental insurance is designed to help cover the costs of various dental services, much like health insurance helps with medical costs. Whether you’re paying for routine preventive care or more complex treatments, dental insurance helps reduce the financial burden associated with these services.

By paying regular premiums, you gain access to a range of dental benefits, including coverage for preventive care, basic treatments, and even major dental procedures, depending on your plan.

Types of Dental Insurance Plans

When selecting dental insurance, it’s essential to understand the various types of plans available:

- Individual Plans: Coverage designed specifically for a single individual.

- Family Plans: These plans extend dental coverage to all family members under one policy.

- Employer-Sponsored Plans: Often offered as a benefit by employers, these plans provide group coverage for employees at discounted rates.

Evaluating your specific needs, such as whether you’re covering just yourself or your family, will help determine the best plan for you.

Dental Insurance Coverage in East London

In East London, several reputable dental insurance providers offer a range of plans designed to cover essential dental services. Understanding what’s included in your coverage is vital to avoid unexpected expenses.

What Does Dental Insurance Typically Cover?

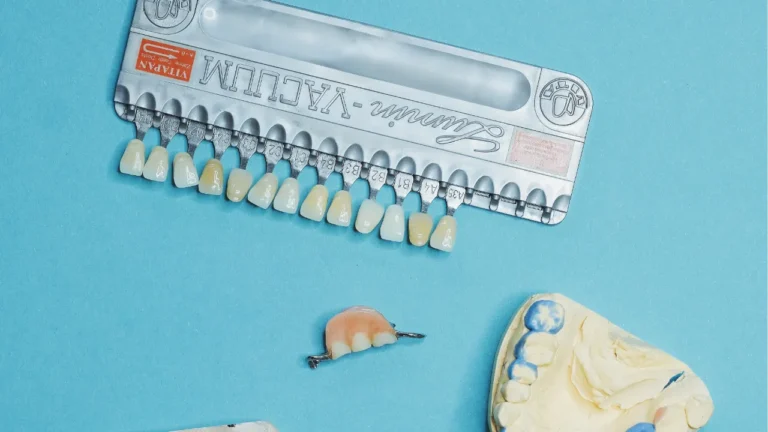

- Preventive Care: Most dental insurance plans cover routine services such as dental cleanings, oral exams, and x-rays. This helps you stay on top of your dental health without out-of-pocket expenses.

- Basic Procedures: Treatments like fillings, extractions, and simple tooth restorations are typically covered, reducing your financial responsibility for essential care.

- Major Procedures: Depending on your plan, treatments such as root canals, crowns, dentures, and even orthodontic treatments may be included. It’s essential to verify these services when selecting your plan.

Understanding Limitations and Exclusions

It’s important to be aware of the potential limitations in your dental insurance coverage, which can include:

- Waiting Periods: Some plans may impose waiting periods before covering certain treatments.

- Annual Maximums: Most plans have a cap on the total amount they will cover within a year.

- Pre-Existing Conditions: Certain pre-existing dental issues may not be covered.

By thoroughly reviewing the terms of your policy, you can avoid unexpected costs when you need dental care.

How to Choose the Right Dental Insurance Plan in East London

Choosing the best dental insurance plan involves evaluating several key factors to ensure you get the coverage you need:

- Cost: Compare the monthly premiums, deductibles, and co-pays across different providers to find a plan that fits your budget.

- Dentist Network: Make sure the plan includes a broad network of qualified dentists in East London to give you plenty of options for receiving care.

- Coverage Limits: Review the plan’s coverage limits for different types of treatments to ensure it meets your potential needs.

- Waiting Periods: Check for any waiting periods that might delay coverage for certain procedures, especially if you need treatment soon.

- Additional Benefits: Some plans offer extra benefits, such as discounts on orthodontic services or cosmetic procedures. These perks can make a significant difference in the long-term value of the plan.

By considering these factors, you can select a dental insurance plan that meets your oral health needs and financial situation.

Maximizing Your Dental Insurance Benefits

To make the most of your dental insurance coverage in East London, consider the following tips:

- Regular Check-ups: Prioritize preventive care, including routine check-ups and cleanings, as they are typically fully covered by dental insurance.

- Early Intervention: Address dental issues promptly to prevent them from escalating into costly procedures.

- Utilize Additional Benefits: Take advantage of any additional benefits or discounts provided by your dental insurance plan, such as reduced fees for orthodontic treatments.

- Review and Update: Regularly review your dental insurance plan to ensure it still meets your needs. Life changes, such as marriage or the birth of a child, may require adjusting your coverage.

Dental insurance is a valuable tool for managing your oral health and finances effectively.

In East London, several reputable dental insurance providers offer comprehensive coverage options to meet your specific needs.

By understanding the various types of plans, coverage options, and the claims process, you can make informed decisions and maximize your dental insurance benefits.

Prioritize regular check-ups, practice preventive care, and explore the additional benefits provided by your dental insurance plan.